China's purchasing managers' index (PMI) was just released and it clocked in at a seven-month high of 55.2 in November from 54.7 in October. The good news is that China's economy continues to expand, which is good for the global economy. The bad news is that it opens the door to more inflationary pressure in the pipeline which will require more monetary tightening. This will continue to pressure AUD/USD lower.

See what's driving the bid and ask in the forex market with the daily "Morning Currency Wrap". Keep up to date with the geopolitical events that are on a trader's mind. Learn about the current trading themes and occasionally pick up a trade call.

Tuesday, November 30, 2010

Europe's Solvency Problem

Ireland, Greece and maybe, in future, Portugal are being rescued by the EU on the basis they have a liquidity problem. They don't. The problem is they can't pay back the money they already owe. And a solvency crisis is not solved by adding more debt.

Morning Currency Wrap for Tuesday November 30, 2010

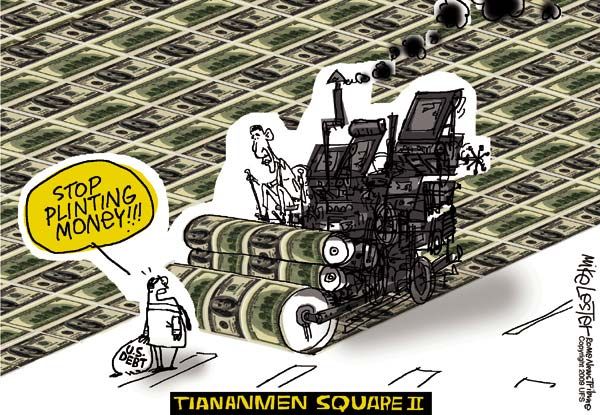

Banksters and Politicians, Who Needs Them - This credit crisis was made possible by lax financial regulation by governments, which then lead to massive risk taking by bankers in order to get big bonus payouts, and finally back to the politicians which then made matters worse by trying to save the banksters with bailouts. EU politicians dragged their feet on Ireland and we now have contagion risk spreading. Now the ECB will be forced to administer their own version of QE in order to stabilize the markets. It was only a month ago that some EU politician were criticizing the U.S. for QE 2, oh how things change. Look I'm not in favour of any sort of money printing operation because it devalues my savings, but at this point the central banks have no other choice - QE will keep going until the monetary system is fixed and we are long way off from that. Why? - because it is up to the politicians, such is the circle of life. Back to the markets, the Euro hit a 10-week low against the USD as contagion fear spreads. The markets has now skipped over Portugal and have demanded larger premiums to hold debt from Spain and Italy. The spreads between these bonds over German bonds has hit their highest since the Euro's launch. If Spain is too big to fail, then Italy is too big to be bailout. The USD continues to gain broadly due to safe haven flow and recent evidence of an improving U.S. economy. The CHF also benefited from safe haven flows from the euro zone area. In Asia, the Yen strengthened to an 11-week high against the Euro and was up against the USD on concern that China will again act to cool its economy. Zhong Jiyin, an economist at the Chinese Academy of Social Sciences, was quoted in the China Daily as saying his nation needs to raise interest rates by 2 percentage points. He went on to say that China’s recent increases in the reserve-requirement ratio won’t be enough to reverse excessive liquidity in the system. In Canada, the CAD fell versus the USD after a government report showed that the nation’s economy expanded at a slower pace in Q3 as a strong currency restrained exports and boosted imports, giving the central bank more reason to keep interest rates unchanged into next year. Overnight index swaps, which reflect expectations for the policy rate, show a 96% likelihood that the bank will stand pat. Canada's Q3 GDP advanced at a 1%, after revised gains of 2.3% and 5.6% in the previous two quarters.

Monday, November 29, 2010

Anti-Retail Traders Tool

Retail traders are notoriously wrong at picking market direction/tops and bottoms. Read more here.

Ireland Slams Door On ECB Exit Strategy

With debt default remaining a risk despite Ireland's bailout, the ECB will be under pressure to abandon any plans it had to exit its ultra-easy monetary policy.

Morning Currency Wrap for Monday November 29, 2010

Bailout Too Little, Too Late, Contagion Fear Rages On - After 3 weeks of dragging their feet, European Union finance ministers endorsed an 85 billion euro rescue package for Ireland and approved outlines of a permanent crisis-resolution system which could make private bondholders share the burden of restructuring sovereign debt after 2013. So where is the bounce in the Euro? There isn't one because they did not act fast enough to stop the fear of contagion and now Portugal and Spain is squarely in the market's sight. Today's Italian bond auction drew lukewarm demand and highlighting investors' unease towards euro zone debt. Also, the cost of insuring Portuguese and Spanish debt against default rose to a record high today. It is hard to imagine the ECB holding to its pledge of removing some of the emergency measures put in place earlier this year in this environment. Turning to the charts, the Euro continues to flash a bearish signal by falling through its 200-day moving average this morning. In Asia, the Nikkei stock index rose to its highest level since June as the Yen continued to weakened against the USD on stronger U.S. economic data last week and continued tensions on the Korean peninsula. In Canada, the CAD has risen to a two-month high against the Euro but remains in a tight range against the USD. Data this week should held the Bank of Canada determine the path of monetary policy for early 2011. This week's date includes GDP for September and employment data for November.

Euro Remains Vulnerable

Airtime: Sun. Nov. 28 2010 | 6:30 PM ET

The euro remains extremely vulnerable despite the announcement that the EU has approved an aid package for Ireland. John Noonan, senior FX analyst at Thomson Reuters, explains why to Dominique Dwor-Frecaut of RBS, CNBC's Bernard Lo, Karen Tso & Sri Jegarajah.

The euro remains extremely vulnerable despite the announcement that the EU has approved an aid package for Ireland. John Noonan, senior FX analyst at Thomson Reuters, explains why to Dominique Dwor-Frecaut of RBS, CNBC's Bernard Lo, Karen Tso & Sri Jegarajah.

From Russia with Love

You can always count on Russia to reinforce it's goal of diversifying its reserves, the world’s third biggest, and promote the use of regional currencies in international trade and finance to reduce risks posed by the dominance of the USD. In this Bloomberg article, we discover that Russia has been busy buying the CAD in order to diversify away from the USD. In this second article, Russia's Vladimir Putin is quoted as saying that Russia will some day join the Euro. Russia recognizes that in order to neutralize the USD, it needs for the Euro to survive and prosper.

Saturday, November 27, 2010

The Week Ahead by MarketWatch Videos

Asia's Week Ahead: Production and Manufacturing Fi

Nov. 26, 2010

This week, Japan's October production figures will provide further clues about the state of the economy. And in China, a manufacturing survey will give an indication of the country's industrial momentum. MarketWatch's Chris Oliver reports.

Europe's Week Ahead: Results From Remy Cointreau

Nov. 26, 2010

Results from Remy Cointreau, Thomas Cook and TUI travel in focus next week. On the economic agenda, the European Central Bank's latest interest rate decision.

Week Ahead: U.S. Market and Economic News to Watch

Nov. 24, 2010

Investors will take the pulse of the consumer economy in the coming week, as the market braces for data from online holiday shopping as well as a fresh look at U.S. consumer confidence. MarketWatch's Rex Crum has a rundown of the top financial news in store for investors next week.

Nov. 26, 2010

This week, Japan's October production figures will provide further clues about the state of the economy. And in China, a manufacturing survey will give an indication of the country's industrial momentum. MarketWatch's Chris Oliver reports.

Europe's Week Ahead: Results From Remy Cointreau

Nov. 26, 2010

Results from Remy Cointreau, Thomas Cook and TUI travel in focus next week. On the economic agenda, the European Central Bank's latest interest rate decision.

Week Ahead: U.S. Market and Economic News to Watch

Nov. 24, 2010

Investors will take the pulse of the consumer economy in the coming week, as the market braces for data from online holiday shopping as well as a fresh look at U.S. consumer confidence. MarketWatch's Rex Crum has a rundown of the top financial news in store for investors next week.

Friday, November 26, 2010

The Day The Dollar Died

Fiction for now, but it is possible.

Thursday, November 25, 2010

Move over China, The Fed is Now the Largest Holder of U.S. Debt

According to Zerohedge, as of November 22, 2010 the Fed's official holdings of US Treasury securities now amount to $891.3 billion, which is higher than the second largest holder of US debt: China, which as of September 30 held $884 billion, and Japan, with $864 billion. Not to self, this is not good. Read the full post here.

China, We are the Masters Now

Harvard University historian, Niall Ferguson, argues that after 500 years of Western prodominance, the world is tilting back to the East and China knows it. Here is a look at the opening paragraph ... "We are the masters now." I wonder if President Barack Obama saw those words in the thought bubble over the head of his Chinese counterpart, Hu Jintao, at the G20 summit in Seoul last week. If the president was hoping for change he could believe in—in China's currency policy, that is—all he got was small change. Maybe Treasury Secretary Timothy Geithner also heard "We are the masters now" as the Chinese shot down his proposal for capping imbalances in global current accounts. Federal Reserve Chairman Ben Bernanke got the same treatment when he announced a new round of "quantitative easing" to try to jump start the U.S. economy, a move described by one leading Chinese commentator as "uncontrolled" and "irresponsible." Read the full article here.

Morning Currency Wrap for Thursday November 25, 2010

Fear of Debt Crisis Contagion Continues to Grip the Market - The Euro remained near a two month low as contagion fear continues to grip the market. Investors continue to dump Spanish and Portuguese bonds on concerns that they will be next to ask for a bailout. In fact, there are real concerns that the bailout fund will not have enough to cover a Spanish bailout. This is causing the market to doubt the ECB will be able to move away from limited auctions of three-month loans, which they have been saying that they would be ending by year end. In short, the ECB will have to continue and enlarge it own version of QE in order to keep things together. In my opinion this crisis has come to be by German Chancellor Angela Merkel’s push for investors to foot more of the bill in future EU bailouts. The market needs to hear that the ECB and Germany are ready to foot the bill in order for this crisis to pass. Meanwhile, the GBP traded higher against the Euro but was down versus the USD on conflicting monetary policy direction. Policymaker David Miles said the Bank of England must avoid any action that could strangle the recovery, but bank hawk Andrew Sentance reiterated it was time to raise interest rates to combat inflation. Sentance is the only hawk so continued monetary easing will prevail. In Asia, the Yen was up on speculation China will take fresh measures to combat inflation. People’s Bank of China adviser Xia Bin said at a conference in Shanghai today that China may need to use reserve ratios and interest rates to control excess liquidity. In Canada, the CAD continues to trend higher as the market is starting to price in sooner than anticipated interest rate hikes. Yields on the June 2011 bankers acceptances contract, a barometer of short-term rate expectations, has risen 1.73%, which is the highest level since July 14. Also, adding to CAD gains has been firmer prices in gold and oil in spite of thin trading due to the U.S. Thanksgiving holiday.

Wednesday, November 24, 2010

Pictorial Guide to Spanish Debt Crisis

Spain is a massive economy, the 5th largest in the European Union, and the fourth biggest in the eurozone. When the time comes for Spain's bailout, the EU/IMF bailout fund may be too small to help because it would have been depleted by bailouts for Greece, Ireland, and Portugal. See the Businessinsider.com pictorial guide to a Spanish debt crisis here.

A Return to the Deutsche Mark?

This article is from UPI's Editor Emeritus, Martin Walker, draws you in from the opening paragraph ... It cannot be reported as fact, but rumor and logic suggest that a highly secret group of German officials is secluded in a discreet Frankfurt office suite and trying to draft a contingency plan for a return to the deutsche mark.

This is not far fetched, in fact I would say it is a real possibility. Why? The EU/IMF funds has already bailout Greece, Ireland should be next, with Portugal not to far behind. The question is will there be enough funds left over to bailout Spain? If not, then Germany would have to step in and I don't think the German population will support that move.

This is not far fetched, in fact I would say it is a real possibility. Why? The EU/IMF funds has already bailout Greece, Ireland should be next, with Portugal not to far behind. The question is will there be enough funds left over to bailout Spain? If not, then Germany would have to step in and I don't think the German population will support that move.

Morning Currency Wrap for Wednesday November 24, 2010

It's the Debt Stupid, Nothing Else Matters - The Euro fell to a two month low against the USD as the uncertainty surrounding Ireland is causing contagion fear to spread to other euro zone countries. Irish opposition parties are threatening to block the passage of a budget that needs to be in place before Ireland is able to tap the EU/IMF fund. Also, unions are banding together to protest proposed cuts to services. If that wasn't enough, S&P cut Ireland's debt by two notches and warned that it may cut it again if Ireland's cost cutting plan is not effective. The reduction leaves its long-term grade five steps above Greece, which has the highest junk, or high-risk, grade. This uncertainty is causing fears to spread to Portugal and Spain - Credit-default swaps insuring Portuguese government debt climbed 13.5 basis points to 500.5 while those for Spain increased 9 basis points to 310, both all-time highs. Bond spreads between the Ireland’s 10-year debt and German bunds has widened by 21 basis points to 607 basis points. Just to prove that nothing else matters right now, look at Germany's IFO report - it showed that confidence among German business in November hit its highest level since reunification in 1990 but yet that did nothing for the Euro. Meanwhile, the GBP rose to its strongest level in nine weeks against the Euro as data confirmed the U.K. economy grew at twice the rate forecast. Let's not get to excited here, the original estimate was only 0.4% for Q3 but with the backdrop of Ireland this number now looks rosy. In Asia, the Yen sold off against the USD, after North and South Korea exchanged artillery fire at a South Korean island near their western border yesterday. But with no new hostilities reported the Yen found a firm level. In the U.S. today, with a market holiday tomorrow for U.S. Thanksgiving, all data releases for the rest of the week will be released today. In Canada, the CAD caught a bid and moved higher across the board as it looked better compared to problems around the world. The CAD also benefited from firmer commodity prices and recovering global stock markets. The CAD also received a boost on news that the world largest manager of bond funds, Pimco, sees value in Canada's debt betting that Canada’s key interest rate will diverge from the U.S. rate.

Tuesday, November 23, 2010

Afternoon Market Highlights by Ashraf Laidi 23-11-2010

A synopsis of the day's developments in forex, equities & commodities.

Investors in Irish banks will have to take Haircuts

In an interview with RTL 7 television, Dutch Finance Minister, Jan Kees de Jager, said that investors in Irish banks will have to take haircuts as part of a restructuring of Ireland's banking system, just like the country itself will have to pay dearly for outside help. "Shareholders and holders of subordinated bonds in Irish banks will have to bleed in a restructuring," he said. And on the option of throwing Ireland out of the euro zone or splitting the single currency area into a weak and a strong bloc, he said "Throwing Ireland out of the Euro is not a good idea, it would provoke a chain of unwanted effects,"

Read the rest of the article here.

Read the rest of the article here.

Morning Currency Wrap for Tuesday November 23, 2010

Sitting on a Powder Keg - We have a full plate on the menu today - Ireland, Portugal, North & South Korea, FBI raids on New York hedge funds, did I leave anything out? With all this going on, it's no wounder that the risk aversion trade is on with a flight to safety in USD and CHF. On the Korean peninsula, artillery fire between North and South Korea caused the South Korean Won to tumble. The central bank of SK called an emergency meeting after S&P said that they would review SK's credit rating due to escalating tensions. The Yen, which usually gains during global tensions, was firm but slightly down versus the USD due to a market holiday in Japan. In Europe, the weekend EU/IMF rescue package for Ireland and its banks was in jeopardy due to political opposition and a possible election call causing the Euro to move lower across the board. It looks like the Irish public is mad and is taking a page out of Iceland's book and is refusing to bailout banks. The usual calming effect on bonds markets after a rescue package is announced is missing this time around due to the uncertainty of the Irish election. This is causing ripple effects in Portugal and Spain - today Spain was forced to almost double the interest paid to investors at a bond auction which raised 3.26 billion euros. The difference, or spread, between the rate that Spain must pay to attract funds for 10 years, and the rate paid by Germany which represents the benchmark rate in the eurozone, also rose to 220 basis points or 2.20 percentage points. In the U.S., FBI raids on hedge funds Level Global Investors LP and Diamondback Capital Management LLC to search for documents into possible illegal insider trades is causing stock markets to sell off, which thereby is forcing up the USD. Meanwhile, the CAD was one of the only currencies to buck the trend as domestic inflation rate in October jumped to a two-year high. Canada's annual inflation rate in October rose to a two-year high of 2.4% from 1.9% in September on higher prices for gasoline and energy. This data is causing the market to rethink the Bank of Canada's stance and could prompt the BOC to raise interest rates sooner than expected.

Monday, November 22, 2010

Germany Will Suffer Too

Nov. 22, 2010

So far, Germany's guarantees of Irish and Greek debt have been cost free. German yields remain very low. But come the inevitable Greek and Irish defaults, Germany's bond market will also start to suffer.

So far, Germany's guarantees of Irish and Greek debt have been cost free. German yields remain very low. But come the inevitable Greek and Irish defaults, Germany's bond market will also start to suffer.

Morning Currency Wrap for Monday November 22, 2010

I & G of the PIGS have been Bailout for Now, When will P and S become a Problem - News of a EU/IMF rescue package in overnight trading propelled the Euro to level last seen on November 11 but the shine quickly came off as the market wounders if the contagion has now stopped. The price action is similar to what happened after Greece was bailout. Will this package be enough? - Time will tell, and I'm sure the experts on bubble TV will be able to enlighten us with their opinions, until then let's concentrate on the price action. For more in depth analysis please read my past post on the blog at http://fxdeskcambridge.blogspot.com. Trading this week will be thin with holidays in Japan on Tuesday and the U.S. on Thursday. Adding pressure to the Euro was Moody's announcement that it may lower Ireland’s credit rating by more than it previously anticipated. Trading in USD/JPY continues to be confined in a tight range. In the rest of Asia, the AUD was up due to the improvement in risk appetite after the Ireland deal helped to negate Friday's surprise move by China to raise bank's reserve requirements. But, NZD was down after an S&P downgrade on New Zealand's foreign currency debt due to a widening current account deficit and credit risks in its banking sector. In Canada, the CAD rallied along with the Euro on the Irish news but then fizzled as concerns that the rescue package may not be enough to stop the contagion. The CAD is still stronger on a relative basis against the crosses, which are trades that do not involve the USD.

Sunday, November 21, 2010

The New Cold War Between China and the USA

A New Cold War

Airtime: Fri. Nov. 19 2010 | 11:00 AM ET

Fed Chief Ben Bernanke is going on the offensive, with CNBC's Steve Liesman; Andrew Busch, BMO Capital Markets.

Currency War Brews

Airtime: Fri. Nov. 19 2010 | 7:43 AM ET

Fed chief Bernanke scolding China and others in his Frankfurt speech saying currency manipulation is hurting the global recovery, with Jim Rickards, Omnis; Ian Bremmer, Eurasia Group; and Nouriel Roubini, Roubini Global Economics.

U.S. vs China

Airtime: Fri. Nov. 19 2010 | 1:21 PM ET

Discussing the new cold war brewing between the United States and China, with CNBC's Eamon Javers, and Ted Truman, Peterson Institute for International Economics.

China 'Hijacked' US Internet Traffic

For an entire 18 minutes last April, a huge chunk of the world’s Internet was routed through servers in China. Fox News says the report by a U.S. congressional advisory group looked at the increasingly sophisticated malicious Chinese Internet attacks.

Airtime: Fri. Nov. 19 2010 | 11:00 AM ET

Fed Chief Ben Bernanke is going on the offensive, with CNBC's Steve Liesman; Andrew Busch, BMO Capital Markets.

Currency War Brews

Airtime: Fri. Nov. 19 2010 | 7:43 AM ET

Fed chief Bernanke scolding China and others in his Frankfurt speech saying currency manipulation is hurting the global recovery, with Jim Rickards, Omnis; Ian Bremmer, Eurasia Group; and Nouriel Roubini, Roubini Global Economics.

U.S. vs China

Airtime: Fri. Nov. 19 2010 | 1:21 PM ET

Discussing the new cold war brewing between the United States and China, with CNBC's Eamon Javers, and Ted Truman, Peterson Institute for International Economics.

China 'Hijacked' US Internet Traffic

For an entire 18 minutes last April, a huge chunk of the world’s Internet was routed through servers in China. Fox News says the report by a U.S. congressional advisory group looked at the increasingly sophisticated malicious Chinese Internet attacks.

Saturday, November 20, 2010

Bernanke is incorrect about Asian Currencies

|

| Source: Societe Generale |

The above chart from Societe Generale suggests the current rate of appreciation for Asian currencies (dollar-Asia index) is higher than it has been over the past decade, which is the exact opposite then what Federal Reserve Chairman Ben Bernanke is saying about Asia. Read more here.

The Week Ahead by MarketWatch Videos

Asia's Week Ahead: Production and Trade Reports

Nov. 19, 2010

Japan will release its October trade report this week, while Thailand, Malaysia and the Philippines will all release third-quarter GDP data. MarketWatch's Lisa Twaronite reports.

Europe's Week Ahead: Economic Data

Nov. 19, 2010

German economic data will be in focus next week, with third-quarter gross domestic product and the Ifo business-climate index on tap. Greece's Alpha Bank and Chilean copper miner Antofagasta are also scheduled to release results.

U.S. Week Ahead: No Holiday for H-P

Nov. 19, 2010

PC giant will report fourth-quarter earnings and shed light on its new CEO, who's gone dark because of a legal spat with Oracle. Also there's a raft of economic data, including home sales, jobless claims and consumer spending. Rex Crum reports

Nov. 19, 2010

Japan will release its October trade report this week, while Thailand, Malaysia and the Philippines will all release third-quarter GDP data. MarketWatch's Lisa Twaronite reports.

Europe's Week Ahead: Economic Data

Nov. 19, 2010

German economic data will be in focus next week, with third-quarter gross domestic product and the Ifo business-climate index on tap. Greece's Alpha Bank and Chilean copper miner Antofagasta are also scheduled to release results.

U.S. Week Ahead: No Holiday for H-P

Nov. 19, 2010

PC giant will report fourth-quarter earnings and shed light on its new CEO, who's gone dark because of a legal spat with Oracle. Also there's a raft of economic data, including home sales, jobless claims and consumer spending. Rex Crum reports

Friday, November 19, 2010

Tech Time At The Currency Lab

Here is some technical work on the major currencies from Mike Ellis's Blog by way of AshrafLaidi.com.

ATCLab11-17

ATCLab11-17

Ireland & The IMF; A Page from Confession of an Economic Hit Man

Ireland and the EU will paint this as not a bailout but a loan for the banking sector of Ireland. The Irish government has been saying for the past 2 weeks that it has enough funds to last them to mid 2011, so why are they being forced to take a loan from the IMF? To save the banks, yes but no. The loan will go a long way to save the banks but the real reason for the loan is to make sure that Ireland doesn't leave the EU or the Euro by indenture. This is exactly how the IMF operates, it loans countries large funds that they can't ever payback and when they default on the loans they expropriate the countries prime assets. They have done this through out Africa, South America, and Central America, just to name a few. John Perkins, chronicled this exact activity in his book Confessions of an Economic Hit Man while he work for a quasi IMF institution.

In this article from the Telegraph, the ECB forces Ireland, and other nations into the web of the EU and IMF by warning that it intends to raise interest rates and withdraw lending support for banks despite the eurozone debt crisis, even if this risks pushing Ireland, Portugal and Spain into deeper trouble.

In this other Telegraph article, Ireland's opposition leader, Enda Kenny, shows that he really understands what is happening when he accuses the Irish premier, Brian Cowen, of raising the "white flag" and subjecting the country to the "dictates" of foreign masters.

In this article from the Telegraph, the ECB forces Ireland, and other nations into the web of the EU and IMF by warning that it intends to raise interest rates and withdraw lending support for banks despite the eurozone debt crisis, even if this risks pushing Ireland, Portugal and Spain into deeper trouble.

In this other Telegraph article, Ireland's opposition leader, Enda Kenny, shows that he really understands what is happening when he accuses the Irish premier, Brian Cowen, of raising the "white flag" and subjecting the country to the "dictates" of foreign masters.

Thursday, November 18, 2010

More Alignment in Currency Movements

As China moves to slow growth, money will flow into safe havens such as the dollar, says Kathy Lien, director of currency research at GFT, adding that the gap between currencies will narrow. She speaks to Mohammed Apabhai of Citi and CNBC's Karen Tso, Bernard Lo & Martin Soong.

Municipal Bond Market has Crashed, Here Comes the Fallout

On the same day, Moody's Investors Service has downgraded the cities of Philadelphia and San Francisco. And you thought only Europe was in trouble.

Euro, from Hope to Hopeless

In one form or another, Ireland will get its bailout. What happen after that, who's next? The ECB is in denial, they are not going to exist easy monetary policy. In fact, they are hours away from their own full fledged QE program. This is the message I get after reading the following three articles:

Bloomberg: Euro Dominos Will Fall Until Currency Is Split

There will be a lot of grand rhetoric about the importance of the European project. Stern condemnations of the speculators will ring out across the continent. Don’t listen to a word of it. The Euro has turned into a bankruptcy machine. Once the markets have finished with Ireland, they will simply move on to Portugal and Spain, and after that to Italy and France.

Spiegel: Irish Debt Woes Make German Banks Uneasy

Both Ireland and Greece have accused German Chancellor Angela Merkel of having triggered the most recent manifestation of Europe's ongoing debt crisis. Merkel and French President Nicolas Sarkozy agreed in late October to a mechanism for sovereign debt restructuring which would require private investors to bear some of the risk for investing in heavily indebted countries like Greece and Ireland. The hope is that such a mechanism would take effect after the €750 billion euro backstop, established early this year, expires in 2013.

Telegrapgh: The Horrible Truth Starts to Dawn on Europe's Leaders

Bloomberg: Euro Dominos Will Fall Until Currency Is Split

There will be a lot of grand rhetoric about the importance of the European project. Stern condemnations of the speculators will ring out across the continent. Don’t listen to a word of it. The Euro has turned into a bankruptcy machine. Once the markets have finished with Ireland, they will simply move on to Portugal and Spain, and after that to Italy and France.

Spiegel: Irish Debt Woes Make German Banks Uneasy

Both Ireland and Greece have accused German Chancellor Angela Merkel of having triggered the most recent manifestation of Europe's ongoing debt crisis. Merkel and French President Nicolas Sarkozy agreed in late October to a mechanism for sovereign debt restructuring which would require private investors to bear some of the risk for investing in heavily indebted countries like Greece and Ireland. The hope is that such a mechanism would take effect after the €750 billion euro backstop, established early this year, expires in 2013.

Telegrapgh: The Horrible Truth Starts to Dawn on Europe's Leaders

Jacques Delors and fellow fathers of EMU were told by Commission economists in the early 1990s that this reckless adventure could not work as constructed, and would lead to a traumatic crisis. They shrugged off the warnings.They were told too that currency unions do not eliminate risk: they merely switch it from currency risk to default risk. But no, the EU masters would hear none of it.

Morning Currency Wrap for Thursday November 18, 2010

Honohan, Not Hawaiian But Irish - Irish central-bank Governor Patrick Honohan is the first Irish official to publicly say that the nation will need aid. Irish citizens and business has been removing deposit from Irish banks over the last couple months which has added to the banks wows. Let's face it, the Irish didn't hide their heads in the sand when trouble started like the Greeks. They didn't cry and they didn't ask for a bailout, they took their medicine and dealt with the problems. What is killing the Irish is their banks, which are bigger than the whole Irish economy. Back to the markets, the Euro was up versus the USD on anticipation of a bailout for Irish banks in the next couple of days. The theory is that this bailout will stop the contagion from spreading to the rest of Europe - don't believe it, this is a classic buy the rumour and sell the fact situation. You will hear today that Spain had a successful bond auction today, but my guess is that the buyer was the ECB in a covert attempt at QE. Problem solved, so the risk trade is back on today causing the USD to drop across the board. Meanwhile, Federal Reserve Chairman Ben S. Bernanke and other Fed officials went on the offensive yesterday to defend the Fed's expansion of its record monetary stimulus. Yesterday's CPI data in the U.S. helped them justify the latest version of QE as inflation was the smallest increase since records started in 1957. Yes, inflation is down but everything I buy comes in a smaller package, give me a break. In Asia, the AUD and NZD were both up as the risk on trade spurred commodity prices higher, while the Yen stayed in a tight range against the USD. In Canada, the CAD strengthened to a 2-day high against the US as crude oil rose above $81 a barrel today and other commodities moved higher as the risk trade was back on due to eased concerns over Ireland's debt crisis. The CAD extended its gains after Canadian leading indicators rose 0.2% in October led by stock market gains, following a revised 0.2% September decline.

Wednesday, November 17, 2010

Ireland, Default Delayed

Ireland will be forced to accept a bailout. But this will only postpone its default. That's because it is already overburdened by debt. All these rescues do is switch the pain from creditors to taxpayers. But taxpayers, particularly German ones, won't stay compliant forever.

European Sovereign Debts, What about American States and Cities

The media would have you think that all the debt problems are in Europe. I can find plenty of articles about Europe's sovereign debt problem but very few about debt wows for American states and cities. Talk about under reporting, I had to dig very hard to find these two stories:

CALIFORNIA WILL DEFAULT ON ITS DEBT, Says Chris Whalen

Cities Face a Deepening Fiscal Crisis

The steep fiscal crisis that many states face includes staggering retirement costs for their workers, estimated at some $3 trillion in unfunded future promises. By the way, these numbers are worse than Europe.

CALIFORNIA WILL DEFAULT ON ITS DEBT, Says Chris Whalen

Cities Face a Deepening Fiscal Crisis

The steep fiscal crisis that many states face includes staggering retirement costs for their workers, estimated at some $3 trillion in unfunded future promises. By the way, these numbers are worse than Europe.

Morning Currency Wrap for Wednesday November 10, 2010

Waiting With Bated Breath - Will a solution be found to Ireland's banking problems before contagion spreads and the dominos tumble? Well we have to wait because a meeting to tackle this problem will be held on Thursday with the European Union, European Central Bank and International Monetary Fund. I forgot to mention that UK officials will also be at the table because a couple of their banks are on the hook to Irish banks to the tune of $150 billion or so. Back to the markets, the Euro remained near 7-week lows against the USD due to the uncertainty of the Irish situation. This morning, the USD gave back some of its overnight gains after U.S. consumer prices rose less than expected in October and the increase in the year-on-year core rate was the smallest on record. The CPI data further supports the Federal Reserve's decision to ease monetary policy and yesterday's comments by Boston Federal Reserve President Eric Rosengren that the Fed would need to consider more stimulus action if the economy weakened. In Asia, the Yen remained close to six week low against the USD as the yield advantage on U.S. paper continued to be the driver in this currency pair. Meanwhile, the AUD was little changed on news that China was implementing temporary measures on prices of some important daily necessities and production materials in order to keep them low for the population. Chinese officials singled out grain, oil, sugar and cotton as markets that it wanted to stabilize. It also vowed to intensify a crackdown on price speculation and to punish those found hoarding commodities and pushing up prices by illegal means. In Canada, the CAD was little changed against the USD after sliding more than a cent yesterday, as soft commodity prices weigh on the CAD as the risk off trade continues to run its course.

Tuesday, November 16, 2010

CAD was under pressure today

After flerting with par last week, the CAD continued its retreat against the USD due to weaker commodity prices as the risk trade comes off. Also, news that Canada’s factory sales fell 0.6% in September after a 2% advance in the prior month will keep the Bank of Canada on the sidelines. The 200 day moving average, which is presently in the 1.0290 to 1.03 area, should halt the CAD's decline.

Moody’s Says Permanent Extension of BushTax Cuts May Lead to U.S Downgrade

After a disastrous G20 summit for Team Obama, now this - Moody's Steven Hess, Senior Credit Officer covering sovereigns, warned that a permanent extension in the Bush tax cuts may lead to a downgrade of the US. Hess also added that pressures on the sovereign rating could develop if the country does not adequately address its debt trajectory. Read more here.

Currency Humour

Morning Currency Wrap for Tuesday November 16, 2010

Waiting On The Irish - Why is the Irish bailout taking so long? It's the banks. Like I've been saying since late 2007, banks around the world are basically insolvent. Bank balance sheets are loaded with toxic assets that are currently being marked at generous levels not market valve. Banks are continuing to bleed red ink and therefore will continue to need support from governments. Government balance sheets are stretched to begin with so when you add the banking strain you get a sovereign debt crisis. The reason the Irish bailout is taking so long is that the EU and IMF facility is for sovereign governments to tap not for banks - so we wait until the EU and ECB can come up with a program to address the continued problems with their banks. Back to the market, the Euro was up off its lows on a better than expected German ZEW survey, rising to 1.8 from -7.2 in Oct. The Euro was also supported by news that a European official with direct knowledge said Ireland is in discussions with European and International Monetary Fund officials about a bailout that would enable it to inject capital into its banks. Strangely, the Euro also received support from comments by U.S. officials, which pulled the USD off its highs. New York Fed President William Dudley said conditions for an exit from U.S. monetary easing could be "years away", while Fed vice chairwoman Janet Yellen defended the Fed's recently agreed bond purchase plan. In the UK, the GBP firmed and moved higher after U.K. inflation unexpectedly rose helping to delay any expectations of QE2 from the BoE. In Asia, the USD was up against the Yen as the gap between U.S. and Japanese bond yields moved further in the USD's favour. Meanwhile in Australia, the AUD was down even though minutes from the RBA's last meeting were slightly hawkish. The RBA will probably not raise rates for a least a couple of months but the real story in what China is doing about interest rates. Continued fears the China will tighten monetary policy led investors to cut long positions in the AUD. In Canada, the CAD continued its retreat against the USD due to weaker commodity prices as the risk trade comes off. News that Canada’s factory sales fell 0.6% in September after a 2% advance in the prior month will keep the Bank of Canada on the sidelines.

Monday, November 15, 2010

Eyeing Ireland

Airtime: Mon. Nov. 15 2010 | 12:50 AM ET

Discussing the market's worries over the euro zone periphery's ability to manage its debt, with Hans Redeker, global head of foreign exchange strategy at BNP Paribas, CNBC's Steve Sedgwick, Chloe Cho and Jackie DeAngelis.

Discussing the market's worries over the euro zone periphery's ability to manage its debt, with Hans Redeker, global head of foreign exchange strategy at BNP Paribas, CNBC's Steve Sedgwick, Chloe Cho and Jackie DeAngelis.

China cozy up to Europe ahead of G20 Summit

From Bill Buckler of the Privateer newsletter, via ZeroHedge blog, prior to the G20 summit in Korea, China was busy cozy up to the Europeans:

Before he travelled to South Korea for the G-20 meeting, President Hu of China spent almost a week in Europe. Shortly before Portugese banks were being downgraded by US ratings agencies, Mr Hu was concluding large trade deals with Portugal. He was concluding even bigger trade deals with France, and going much further. With the Seoul summit now over, France has taken over the presidency of the G-20 from South Korea. At a State dinner in his honour in Paris, President Hu publicly said that “China supports France in its efforts to ensure the success of the G-20 summit next year”. French President Sarkozy has made it clear that his top priority is a fundamental reform of the world’s monetary system, a priority he shares with Germany and, in President Hu’s own words, with China.

Before he travelled to South Korea for the G-20 meeting, President Hu of China spent almost a week in Europe. Shortly before Portugese banks were being downgraded by US ratings agencies, Mr Hu was concluding large trade deals with Portugal. He was concluding even bigger trade deals with France, and going much further. With the Seoul summit now over, France has taken over the presidency of the G-20 from South Korea. At a State dinner in his honour in Paris, President Hu publicly said that “China supports France in its efforts to ensure the success of the G-20 summit next year”. French President Sarkozy has made it clear that his top priority is a fundamental reform of the world’s monetary system, a priority he shares with Germany and, in President Hu’s own words, with China.

Interactive Map of Global Debt

With debt rising faster than economic output, this is fast becoming the greatest threat to global stability. What is even scary is that this map does not include the unfunded liabilities of various governments, after all they are just government promises. Click here to see the interactive global debt map from the Economist.

Morning Currency Wrap for Monday November 15, 2010

Ireland is Playing Hardball with the EU - The EU is desperate and Ireland knows it. The Irish government continues to deny it needs a bailout citing that its debt requirements are funded until mid-2011. Ireland and other EU countries are not amused that Germany is trying to do an end run around EU policies by pushing the idea of asset value reductions or "haircuts" for private bondholders under a permanent euro zone rescue mechanism it wants in place from 2013. Will it looks like Ireland is playing hardball because it knows that the EU wants to avoid a a Greek-style scenario where budget problems in one country cause a contagion and plunges the entire euro zone into crisis. We will see how this plays out but for now the Euro is under pressure. In Asia, the USD as moved above 83 Yen for the first time in more than five weeks as rising bond yields and signs U.S. economic growth is gathering pace boosted demand for the USD. Japan's GDP grew at an annualized 3.9% in the Q3 but this news was not enough to bolster the Yen in this risk off environment. In the UK, the GBP has been able to hold its own despite news that Rightmove Plc, the operator of Britain’s biggest property website, said the average asking prices for homes in England and Wales fell 3.2% this month to 229,379 pounds ($371,000). That’s the biggest monthly drop since December 2007. In the U.S. today, data was mixed as advanced retail sales for October came in at 1.2% over the expected increase of 0.7% while the Empire Manufacturing Survey came in at -11.1, which comes in sharp contrast to the 11.7 that had been expected. This was a steep reversal for the EMS from the 15.7 registered for the prior month, but this survey is usually very volatile so the market has shrugged it off. In Canada, the CAD followed the USD higher as signs that U.S. economic growth is gathering strength is a positive for the CAD. News that BHP Billiton had officially scrapped its $39 billion bid for Canadian fertilizer giant Potash Corp. after Ottawa had blocked the proposed takeover a couple of weeks ago had little impact on the CAD.

Sunday, November 14, 2010

Crunch Time for the ECB

If the ECB wants to keep the monetary union in tack, then it better join the Fed and start printing Euros in order to buy up Irish sovereign debt. This is no joke, if they don't start soon we will get contagion. Read this great article by Ambrose Evans-Pritchard of the Telegraph here.

Possible Euro Reaction to Irish Bailout

In this article, forex trader analyst, Kathy Lien, describes what could happen to the Euro if Ireland were to get a bailout. Let me add a couple of my own thoughts here. If Ireland undergoes a restructuring of debt, then the Euro will plunge. Why? - because the market will only assume that this is the way things will be resolved if Spain or Italy get into trouble. On the other hand if Ireland receives a bailout from the EU and the IMF, then the Euro may fall a little but it should be cushioned by the opposite force of the Fed's QE 2.0.

My guess is that before the Asian markets open for business, Ireland will be forced by the EU to ask for a bailout in order to stop a contagion from spreading to other European countries, which do have solvency issues, yet have been spared the liquidity hammer so far.

The G20 summit has failed, not surprising, as usual it failed to diagnose the problem itself. The fact that countries are becoming aggressive about currencies is merely a symptom of a far deeper issue: that the international monetary system has failed, and there is no one willing or able to come up with a reconstruction job.

From this excellent Telegraph article - In an ideal world, one would like to have fixed exchange rates (so that companies can trade internationally without worrying about currency movements), free movement of capital (so investors can put money where it’s most needed) and independent domestic monetary policy (so you set interest rates dependent on how fast or slow your economy is growing). Unfortunately, one can only have two of these three at any one time. Under the 19th century Gold Standard, policy makers gave up independent domestic monetary policy in favour of a system of fixed exchange rates (tied to gold) and free-moving capital. Then, from the 1940s to 1970s, the Bretton Woods system again retained fixed currencies but gave up free capital movement in favour of independent monetary policy. From the 1970s to today Western nations swung behind floating currencies and free capital movement, while retaining independent monetary policy.

Things will only get worse before they get better - With the huge defeat of the Democrats in the recent mid-term election, the Tea Party movement will only intensify global imbalances with a movement towards protectionism.

Saturday, November 13, 2010

The Week Ahead by MarketWatch Videos

Asia's Week Ahead: Watch for Japan's GDP

Nov. 12, 2010

Japan will release its quarterly GDP data this week, and the Bank of Korea will announce a key interest rate decision. MarketWatch's Chris Oliver reports.

Europe's Week Ahead: Burberry and Infineon Report

Nov. 12, 2010

Several European firms will report results next week, including British luxury fashion house Burberry and German chipmaker Infineon Technologies. Minutes from the Bank of England's latest meeting and Germany's ZEW economic-sentiment survey are also on the calendar.

U.S. Week Ahead: Earnings, Economic Reports

Nov. 12, 2010

Wal-Mart, Dell and Home Depot lead the earnings parade, while retail sales, inflation figures and housing starts top the economic data. And General Motors' return to the public markets looms. MarketWatch's Rex Crum reports.

Nov. 12, 2010

Japan will release its quarterly GDP data this week, and the Bank of Korea will announce a key interest rate decision. MarketWatch's Chris Oliver reports.

Europe's Week Ahead: Burberry and Infineon Report

Nov. 12, 2010

Several European firms will report results next week, including British luxury fashion house Burberry and German chipmaker Infineon Technologies. Minutes from the Bank of England's latest meeting and Germany's ZEW economic-sentiment survey are also on the calendar.

U.S. Week Ahead: Earnings, Economic Reports

Nov. 12, 2010

Wal-Mart, Dell and Home Depot lead the earnings parade, while retail sales, inflation figures and housing starts top the economic data. And General Motors' return to the public markets looms. MarketWatch's Rex Crum reports.

Friday, November 12, 2010

Chinese sub pops up in middle of U.S. Navy exercise

American military chiefs have been left dumbstruck and red faced by an undetected Chinese submarine popping up at the heart of a recent Pacific Navel exercise. By the time it surfaced the 160ft Song Class diesel-electric attack submarine is understood to have sailed within viable range for launching torpedoes or missiles. The Americans had no idea China's fast-growing submarine fleet had reached such a level of sophistication, or that it posed such a threat. Read the entire story here.

You think China wanted to send a message to the Americans during the G20 summit in South Korea. Come to think of it, I'm beginning to think that China was responsible for that unconfirmed missile launch off the coast of California this week.

You think China wanted to send a message to the Americans during the G20 summit in South Korea. Come to think of it, I'm beginning to think that China was responsible for that unconfirmed missile launch off the coast of California this week.

G20: U.S. Hit by Trade Setback

Discussing whether the United States is losing an image war to China, with Ned Riley, Riley Asset Management; Rob Lutts, Cabot Money Management; and Michael Hewson, CMC Markets.

Thursday, November 11, 2010

US vs. China: Who's the Bully?

Who's the bigger bully in the global economy now - the US or China? Gerald O'Driscoll, former vice president of the Dallas Federal Reserve, and Peter Navarro, a business professor at UC Irvine, share their opposing views.

US Won't Weaken Dollar to Spur Growth: Geithner

The United States will not weaken the dollar as a tool to gain competitive advantage or to grow its economy says, U.S. Treasury Secretary Timothy Geithner. He tells CNBC why this is "not an effective strategy for any country". What else is he going to say!

U.S. Faces Critics On Buck

The U.S. facing critics on its dollar polices at the G20 Summit, with Marc Chandler, Brown Brothers Harriman. Surprising, the commentaries were trying to stop him from being such a homer.

Wednesday, November 10, 2010

Dollar Strength Requires Policy Change

Neil Mellor, currency strategist at BNY Mellon, told CNBC Wednesday that there will not be dollar strength while US monetary policy is kept loose. He attributes the country's continuing fiscal deficit to a mismatch in the requirements of the US Treasury and the actions of the Federal Reserve. He added that dollar gains against the euro aren't a result of QE, but are "euro doubts revisited."

Is Another Credit Crises Around the Corner?

If you think the global outcry over the amount of liquidity being created by the Fed's $600 billion QE 2.0 asset buying program is reaching a fevered pitch, wait until the world finds out that this is just a drop in the bucket. Over the next 3 years, major banks around the world will need to refinance over $5 trillion - why? - because they are basically insolvent due to the mounds of toxic assets on their balance sheets. Where will the money come from, you guessed it, central banks around the world in the form of QE. Read about the looming credit crunch 2.0 in this Telegraph article here.

Chinese Cartoon on Wall Street

A fitting reminder on how the rest of the world views the current state of Wall Street.

Morning Currency Wrap for Wednesday November 10, 2010

Yesterday's Flash Crash Caused by 30% Hike in Silver Margin Requirements - Yesterday the CME Group it raised its silver futures trading margins by 30% to $6,500 an ounce from $5,000 an ounce effective Wednesday. This caused a knee jerk reaction in the commodity complex, silver futures surged as much as 6% before retreating, with volume rising to an all-time high on Tuesday, boosted by extreme price volatility and possible short covering. Since all commodities are prices in USD, the USD surged as commodities sold off. Today, we should see a snap back in all commodities because anytime the CME raises margins it is a bullish sign. In Asia, China’s currency appreciated as much as 0.2% to 6.6329 per USD, the strongest level since China unified official and market exchange rates at the end of 1993. China also ordered its banks to put more money aside as required reserves, a tightening step that mops up some of the cash that has been streaming into the country and posing a growing inflationary threat. Meanwhile, the Yen was down against the USD as equity markets were up causing the risk trade to be back on after yesterday's run to safe havens. In Europe, the Euro is up off its lows as sovereign debt wows intensified in Ireland. The fear may be a little overblown here because this is not new news, there is a solution if Ireland needs it with the ECB and the IMF. Real problems could develope for the Euro if Spain runs into trouble. Meanwhile in the UK, the GBP performance was sterling as the Bank of England's quarterly inflation report poured cold water on possible resumption of asset purchases any time soon. Inflation was 3.1% in September, exceeding the government’s 3% limit for a seventh month. In Canada, the CAD surged higher despite news that Canada posted a larger-than-expected trade deficit in September. The trade deficit came in at C$2.49 billion from a revised C$1.49 billion deficit in August as exports to the U.S. tanked and imports climbed to their highest level in nearly two years. The CAD took its cue from U.S. jobless claims, which fell in the latest week, suggesting some stability in the labor sector.

Tuesday, November 9, 2010

China Continues to Vent

China’s Dagong Global Credit Rating Co. reduced its credit rating for the U.S. to A+ from AA, citing a deteriorating intent and ability to repay debt obligations after the Federal Reserve announced more monetary easing.

The downgrade came before a meeting of Group of 20 leaders this week in Seoul and as the U.S. steps up pressure for China to let the yuan strengthen to help reduce the U.S. trade deficit. China countered the criticism by saying U.S. economic policies threaten the stability of developing nations.

Read the rest of Bloomberg's coverage here.

The downgrade came before a meeting of Group of 20 leaders this week in Seoul and as the U.S. steps up pressure for China to let the yuan strengthen to help reduce the U.S. trade deficit. China countered the criticism by saying U.S. economic policies threaten the stability of developing nations.

Read the rest of Bloomberg's coverage here.

Trouble Brewing in Ireland

If you thought the Irish bank bailout was bad, wait until the mortgage defaults hit home. Irish household are struggling to pay mortgages they cannot afford because of the stigma attached to default. But in time this will change as the Irish take a page out of the U.S. household's play book and walk away from their obligations. The perception growing among borrowers is that while they played by the rules, the banks certainly did not, cynically persuading them into mortgages that they had no hope of affording. Given Ireland's history, this could lead to social uprising. The market will soon realize that Ireland is effectively insolvent and put added pressure on the Euro. Read the grim outlook for the brewing mortgage default here.

Morning Wrap for Tuesday November 9, 2010

Risk Aversion - The USD, Yen, CHF, CAD, and gold are all up today as market players avoid the risk trade on continued concerns that European countries will struggle with budget deficits and after China signaled that it intended to implement capital flow restrictions of hot money into their economy. In Europe, the extra yield investors are demanding to hold debt from Portugal and Ireland has climbed to record levels over similar German debt putting added pressure on the Euro. The spread on 10 year bonds between Germany and Portugal is about 450 bps, Irish spreads have pushed past 550 bps, and Greek spreads have widen to over 900 bps. Greece was able to issue 390 million euros of six-month debt today but they had to pay 28 basis points more in yield compared with an October sale. The uncertainty is fueling the CHF over the Euro. In Asia, China’s State Administration of Foreign Exchange said today it would crack down on speculative “hot money” flowing into the country, according to a statement on the regulator’s website. China will force banks to hold more foreign exchange, strengthen auditing of overseas fund raising, and also regulate Chinese special-purpose vehicles overseas by tighten controls on equity investments by foreign companies in China. These measures are a response to the monetary stimulus by the Fed's QE 2.0 ahead of this week's G20 summit in Seoul. The chorus of criticism toward the Fed's QE 2.0 has risen ahead of the G20 meeting making a possible resolution to the currency wars unlikely. Elsewhere, the NZD was under pressure on reports the U.S. had stopped importing kiwi-fruit vine on worries that an orchard could be infected with a virus. In Canada, the CAD moved slightly over parity this morning as competitive currency devaluations is fueling a rise in commodities. The CAD received a boost after Canadian new-home prices rose 0.2% in September which had slowed since the government ended temporary stimulus measures and Bank of Canada Governor Mark Carney warned about record high household debts.

Monday, November 8, 2010

Three Best Currency Bets Right Now

According this Pivot Farm chart, the three best currency bets right now are to go short USD/JPY, USD/CHF, and USD/CAD. Read the reasons why here.

Euro Loses As Market Amnesia Fades

With QE2 launched and the U.S. midterm votes out of the way, investors are starting to dimly remember other economies; other problems.

World Bank president Robert Zoellick Calls for a Gold Standard

In Op-Ed piece in the Financial Times, World Bank president Robert Zoellick says that current system of floating currencies established by the 1971 Bretton Woods II system, has broken down. He says that it is time to look to a new international system of commerce, one which "is likely to need to involve the USD, the Euro, the Yen, the GBP and (Yuan) that moves toward internationalization and then an open capital account." He added: "The system should also consider employing gold as an international reference point of market expectations about inflation, deflation and future currency values."

Well this is a start, but I don't see the Bric countries agreeing to this framework because it includes fiat currencies. Look the reason for changing the current systems is because Bric countries are losing faith in the fiat currencies so why would they agree to have them in the basket. I think it will need to include some other commodities for this to fly.

Well this is a start, but I don't see the Bric countries agreeing to this framework because it includes fiat currencies. Look the reason for changing the current systems is because Bric countries are losing faith in the fiat currencies so why would they agree to have them in the basket. I think it will need to include some other commodities for this to fly.

Subscribe to:

Comments (Atom)